Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

The 500 euro note has a habit of going missing.

This blog draws heavily on the original, but also looks at the latest report from the Luxembourg Central Bank.

In June I highlighted a Europol (European Police Office) report on money laundering. ( You might not think that money laundering regulations will touch you, but the FCA requires all IFAs to carry out basic money laundering checks before working with clients )

Europol’s report explains a variety of money laundering methods and criticises the lack of controls within the Eurozone on the reporting and movement of cash. And Europol are especially interested in the use of cash as, to quote them, ‘although all cash is not criminal, all criminals use cash at some stage in the money laundering process’.

And if you’re going to move cash around it helps if you have a note with a large denomination. Nicknamed ‘Bin Ladens’ from the time when we knew he existed but not where, the 500 euro note means that 10 million euros in paper weighs little more than the average airline baggage allowance – 22 kg.

The European Central Bank (ECB) itself estimates that over 300 billion euros of its banknotes are held overseas. And in June it announced that no new 500 euro notes would be issued after 2018 as they were ‘taking into account concerns that this banknote could facilitate illicit activities’.

It will be interesting to see whether issuance of the largest notes has changed when the main central banks report next year. In recent years, overall eurozone production of ‘Bin Laden’s’ has been growing. But one central bank stands out in particular, the Banque Central du Luxembourg (BCL)

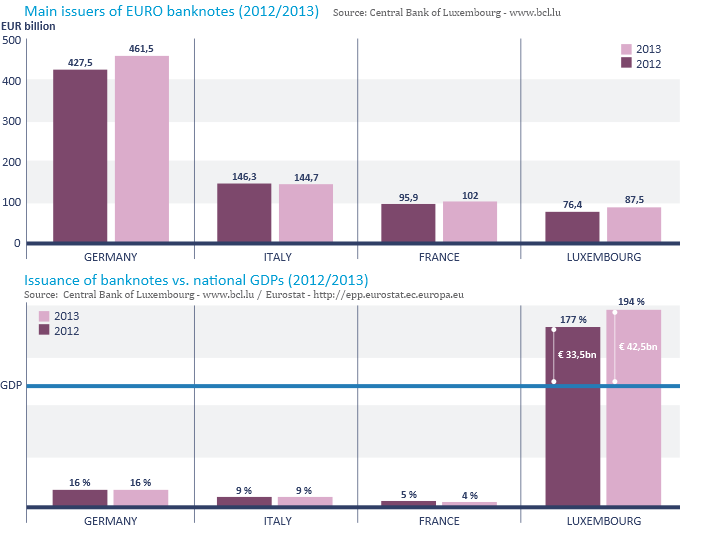

Below is a graphic from the Europol report which shows data from 2012/2013.

The top graph highlights the four main issuers of euro bank notes, Germany, Italy, France and Luxembourg. But, the second graph highlights the scale of Luxembourg’s issuance compared to the size of its economy.

As the source for the graphs shows, this information can also be found in the annual report of the BCL itself. And I was interested to see how much issuance has changed in their latest report for 2015, which was not available when I wrote the first blog in June.

500 euro notes even go missing from the BCL annual report.

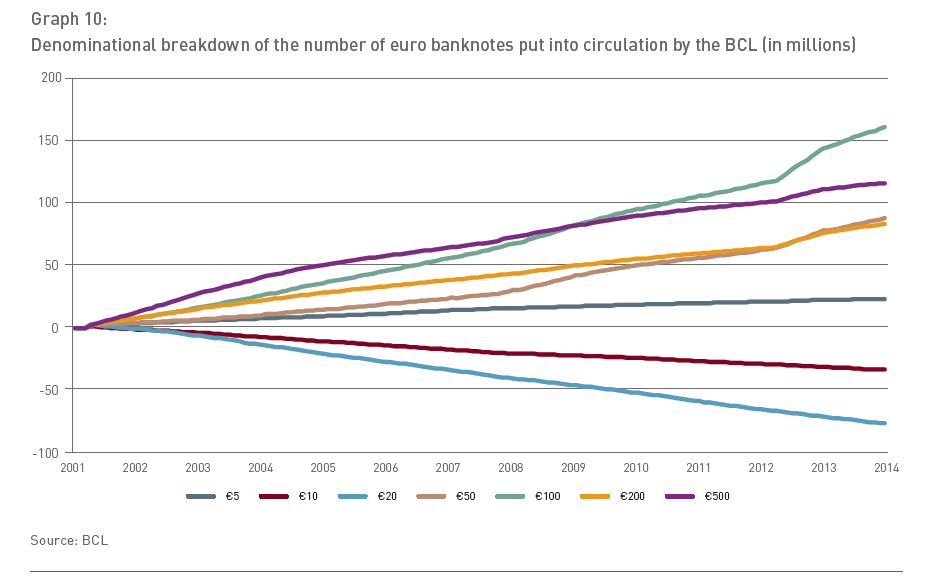

In the first section on the amount of new cash issuance, the report refers to demand for the largest notes falling. But, in fact, it’s just the percentage rise in issuance that’s falling, the value of the largest notes issued has increased again.

In the previous year’s report the BCL detailed the amount of each euro note produced. They did the same in each of the reports from 2010 – 2013. However, in its latest report for 2015, these statistics are not included.

They have been replaced with statistics for the Eurozone as a whole, which is how they used to report the data prior to 2010. But one has to ask, why the change? They’ve also chosen to only release the report in French the last time I checked.

Perhaps they are especially sensitive now the 500 note will no longer be issued and the reasoning behind that decision. Or it might be the case that a combination of an O-level (yes, I’m that old) in French and Google translate have meant that I’ve completely misinterpreted the report.

A dash for cash.

It should also be remembered that the ECB decision to stop new issuance of the largest note might not all be about preventing money laundering.

Legitimate demand for cash is bound to increase as the European Central Bank pursues a policy of negative interest rates i.e being charged for deposits. And several regional German banks are already considering holding part of their reserves as cash rather than being charged for holding them directly with the central bank.

The same will be true of general savers if banks there introduce charges for retail customers as they have with the largest corporate customers. All of which negates the effect of negative interest rates in the first place.

For the policy to work as they expect you need to reduce the availability of cash as an alternative store of value whether you’re a private citizen, business, drug baron or leader of an international sporting federation.

Update: An FT article dated 16th August, covers this issue in more depth, ‘Banks look for cheap way to store cash piles as rates go negative’

You can find the BCL’s annual reports here

There are two blogs on the implications of negative interest rates here and here.

Ending on a different high note.

To those of you with a love of music, here’s Mr Les Dawson showing us all how to really hit the top of your vocal range. This is his emotive rendition of ‘Feelings’ – enjoy.

Please remember:

- past performance is no guide or guarantee of future returns;

- the value of stock market investments can rise and fall over time, so it is quite possible to get back less than what you put in, depending upon timing;

- this blog does not constitute financial advice and is provided for general information purposes only.