Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

Why the ECB has decided to stop issuing the 500 euro banknote by the end of 2018

Lost between the Panama Papers revelations and this week’s anti-corruption summit in London was the news that the European Central Bank (ECB) would no longer issue its biggest banknote from the end of 2018.

At the end of a blog concerning FIFA titled, ‘Sheikh, Blatter and Mole’, I mentioned the relative attractiveness of the 500 euro banknote for processing ill gotten gains.

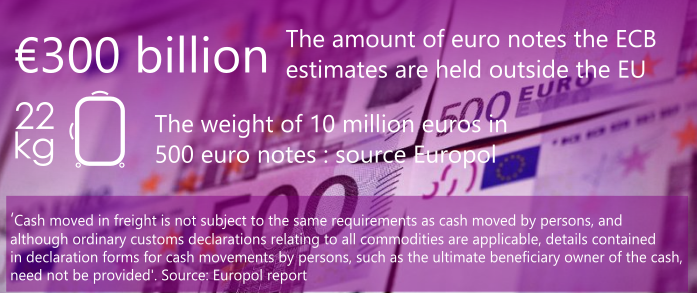

Nicknamed ‘Bin Ladens’ from the time when we knew he existed, but not where, Europe’s largest note accounts for 30% of the value of all euro banknotes. And the ECB estimates that over 300 billion euros of its banknotes are held overseas.

That’s a lot of cash. If they were all 500s that would amount to 600 million notes, weighing 660 metric tons.

The BBC only gave the announcement a short report on its website. But it did explain the ECB’s decision was due to concerns the banknote could facilitate illegal activities. There was also a link to a Harvard report urging the removal of large notes to help tackle crime.

And for a quote they turned to Peter Sands, former chief executive of Standard Chartered bank, who said the high-denomination notes were favoured by terrorists, drug lords and tax evaders.

Mr Sands is an interesting choice. He certainly knows about the difficulties of enforcing financial regulations.

Standard Chartered was fined $667 million in 2013 for major breaches of US sanctions against Iran and three other countries. His chairman didn’t help matters by referring to those breaches at a shareholder meeting as being ‘mistakes’. The next day ‘mistakes’ was changed to ‘willful’.

And then there was the apparent quote from one of their London based executives to US officials saying, ‘you f***ing Americans. Who are you to tell us, the rest of the world, that we’re not going to deal with Iranians?’.

Well, where there’s a digital record of a dollar transaction, they can do just that, as the fallout from the FIFA saga has shown. Whether it’s always just is another matter.

How much of a money laundering problem are large denominated banknotes?

To answer that you need to look at last year’s 54 page Europol report titled, ‘Why is cash still king?’

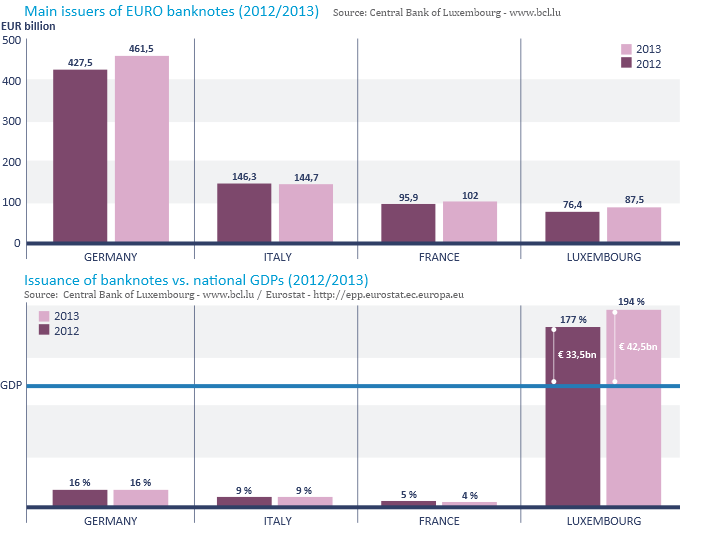

One anomaly it highlights is the number of 500 euro banknotes issued by the Banque Central du Luxembourg (BCL).

In the BCL’s own 2014 report it states that, to date, it has issued nearly 95 bln worth of euro banknotes. Of these 60 billion are the highest denominated 500 note – that’s a lot of cash for just over 400k financially active citizens. Especially when one survey suggested that 56% of Europeans have never even seen the largest banknote.

So, demand for the banknotes must relate to other clients of its banks and the concern is that, as elsewhere, some of this is illegitimate – but how much?

Europol explain their problem as ‘although not all cash is criminal, all criminals use cash at some stage in their money laundering process’.

And the problem involves more than just looking at which central bank issues what notes where.

The report gives known examples of large scale financial abuse, and describes a variety of laundering techniques with names like ‘cuckoo smurfing’. But it doesn’t suggest a specific figure for the level of illegal activity.

Another problem is the lack of co-ordination within and between member states. There are also different systems of declaration, penalties, co-operation and enforcement.

Even in member states that do have a system to confiscate money until its proved legitimate, they can only do so for a fixed period. This may be too short to process supporting documents, that may be in Chinese for example, and so release the cash anyway.

So, will restricting Europe’s largest note make any difference?

Europol immediately released a statement welcoming the announcement, but their own analysis highlights the problems of enforcement. And existing notes will still be valid and presumably more notes can be issued prior to 2018.

Money laundering enforcement is like a game of whack-a-mole. You can restrict the 500 note, but the 100 and 200 denominations will remain. And then there are alternatives such as the 1000 swiss franc note.

But that doesn’t mean the you shouldn’t at least have a ‘whack’.

Here in the UK, banks haven’t handled the 500 euro note since 2010 when the Serious Organised Agency estimated 90% were in the hands of organised crime. And money laundering regulation and enforcement is high up the FCA’s list of priorities. It extends to this firm and its clients.

But, in fairness, the Luxembourg central bank might suggest that there are British crown dependencies and overseas territories that could equally do with a regulatory ‘whack’.

Why the delay in implementing the policy if the case for misuse is clear?

This is a valid question since the UK and other leading economies operate effectively with far smaller banknotes. And digital money is widely accepted across Europe – there have already been 3 billion ‘contactless’ payments this year.

However, in an ironic twist, the ECB’s own monetary easing policy is making legitimate use of large notes as a store of value more attractive to everyone. And this is creating strong political resistance against limiting the use of cash. Cash, by its very nature, limits the ability of central banks to force negative interest charges on bank deposits.

If your bank charges you to keep your money, why not withdraw it as cash?

As Andrew Haldane, Chief Economist at the Bank of England has stated, imposing negative interest rates on the public won’t work without restrictions on the use of cash. That means they will likely have to take a different route if the economy doesn’t pick up.

Japan is already hitting problems with negative rates. But, believe me, the central banks are all making plans.

More on that in another post.

If you find the idea of how banknotes are issued a little confusing here is a video on the Luxembourg central bank website that explains their legitimate life cycle.

Please remember:

- past performance is no guide or guarantee of future returns;

- the value of stock market investments can rise and fall over time, so it is quite possible to get back less than what you put in, depending upon timing;

- this blog does not constitute financial advice and is provided for general information purposes only.