Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

Expertise

Below, I explain some of the experience that I can draw on to help our clients navigate the investment landscape once we’ve carefully established your goals and attitude to risk.

There are three main areas – professional qualifications, practical experience and theoretical knowledge.

Chris Pearce, Director.

Professional qualifications – Chartered MCSI and Chartered Wealth Manager

All advisers are required by the Financial Conduct Authority to demonstrate competence by attaining ‘level 4’ qualifications and maintaining that standard with an accrediting body. Many advisers choose the Chartered Insurance Institute, but I chose the Chartered Institute for Securities & Investment as they have more of an investment bias.

My own designation is as a Chartered MCSI, which means that I have achieved the minimum of a ‘level 6’ qualification and have the required experience to be a chartered member of the CISI. However, I am also a Chartered Wealth Manager, which is a separate designation that the CISI awards ‘to recognise senior members in the retail sector at the pinnacle of their profession’.

That sounds a bit grand, but achieving it does require some considerable study and maintenance of professional and ethical standards.

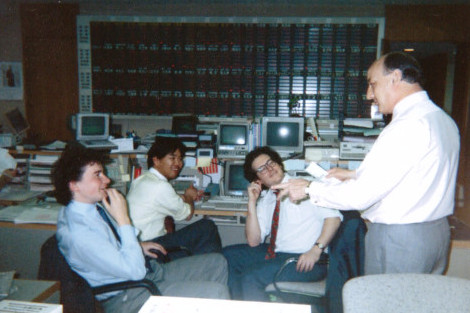

Practical experience – It’s almost 30 years since I started in finance.

My career in finance began in the mid 80s with an international stock broker called James Capel. James Capel built their reputation on the quality of their research and it was a fantastic environment to learn in – especially in, what was then, a new area of finance known collectively as ‘derivatives’.

While I was there and at other companies overseas, I traded on behalf of a diverse range of clients in equities, currencies, bonds and their derivatives. And those four markets are the building blocks of most investment products that you see today.

Also, the best experience doesn’t come from the humdrum of everyday business, it comes from those occasions when markets are experiencing extreme volatility. I’ve managed clients through plenty of those – from the crash in 1987, the collapse in Japan in the early nineties and the events of 9/11. And that previous experience was crucial when navigating the last financial crisis in 2008.

Below is a map showing most of the markets I have traded in for clients and where those same clients were located. I have also included markers for the location I most associate with just a few of my immediate colleagues – we were a pretty diverse and international bunch.

Your mouse wheel allows you to zoom in and out to reveal more markers – and if you click on any of them more information will appear.

loading map - please wait...

Theoretical knowledge – It’s over 25 years since I first used the mathematics that is now employed by a few financial planners in their forecasts. Those calculations also form the backbone of the SumItApp ‘dynamic’ retirement planning software that I’ve developed for our own clients.

Financial theory can get a little complicated and it’s based around developing models that replicate price movements and risk in the real world. All financial professionals should understand that these models are essentially like medicine in that they all have side effects. If you have some mathematical knowledge and a lot of practical experience that should be reasonably clear.

But how does this apply to financial planning?

Well, some of these techniques are very useful when estimating the range of future returns on client investments and software like our own SumItApp planner help illustrate the impact of risk and loss on the future performance of investments and pensions.

They are very useful tools, but when using such a financial barometer you should understand its limitations and to do that you need both practical and mathematical knowledge. They can never guarantee performance, but they can give you a good idea of the chance of specific financial targets being met over time and help illustrate the answers to questions, such as ‘will my money last my lifetime?’