Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

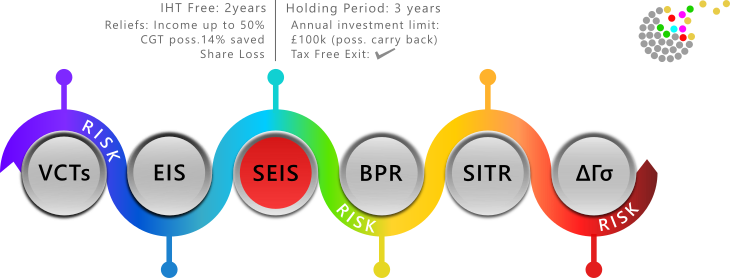

SEIS – Seed Enterprise Investment Schemes

Seed Enterprise Investment Scheme (SEIS) were introduced in 2012 to complement the existing Enterprise Investment Schemes (EIS) by extending the tax incentives to provide finance to even smaller and likely more risky ventures.

The incentives and governing structure are very similar to that for an EIS and we’d suggest you read our introduction to the largest recipient of venture capital reliefs first. That similarity is deliberate as it is hoped that companies that survive under a SEIS go on to benefit from EIS funding.

Investments, as with an EIS, may be into a single company or a pooled series of investments controlled by a discretionary fund manager. The pooled investments are made directly on behalf of the investor, not indirectly as would be the case with a venture capital trust.

Investors are therefore looking for the fund manager to provide considerable expertise in terms of sourcing appropriate investments and performing quite onerous due diligence.

It should also be said that by their very nature there is a quite large attrition rate in the pool of investments, possibly over half. But, the fact that the balance hold their investment value and that a few of those will multiply in value, means that returns can still be positive.

This heightened risk is reflected in more generous reliefs than available to EIS investors, but the maximum investment amount is set at only £100,000, a tenth of that for an EIS. Investors must hold the SEIS for a minimum of three years and the investee company must remain compliant in that time. The main reliefs are:

- tax free capital growth

- income tax relief at up to 50% (EIS 30%)

- capital gains tax reinvestment relief (investors can benefit from 50% capital gains tax relief on gains which are reinvested in SEIS eligible shares)

- possible additional income tax relief on losses

- up to 100% business relief (BR) from inheritance tax after two years

From HMRC’s own report on EIS and SEIS in April 2017 we can get an idea of the size of the fund raising over last year of complete assessment figures, 2015/16. Then 2,225 companies received SEIS investment totalling £170 million. And of those, over 75% were raising funds for the first time. Since George Osbourne introduced the scheme in 2012, 6,515, companies have raised £608 million.

The main risks are as per EIS, they are early stage equity investments and exiting within the chosen time frame may be difficult. Tax rules can change. There is also the problem of monitoring investment performance and the extra level of due diligence that is required of both the fund managers and those of us assessing, in turn, those same managers.

We attempt to use as much publicly available information as possible in our due diligence process before we even approach the fund manager. And to date we’ve highlighted some pretty colourful issues of governance that other reviews have failed to consider.