Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

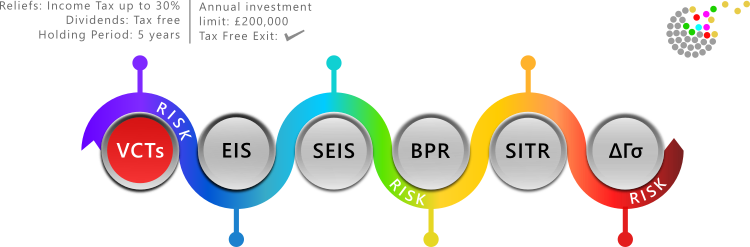

VCTs – Venture Capital Trusts

Venture capital trusts (VCTs) were established in 1995 as part of a government initiative that earlier included the two types of enterprise investment schemes. The general aim was to encourage investment in riskier small unlisted companies by offering a range of tax reliefs if those businesses met and maintained certain criteria.

The VCT structure is very similar to an investment trust and can also be compared to listed private equity company. They are listed on regulated markets and the appointed fund managers are able to make pooled investments in companies of as much as £5 million (technical limit is £15 million) that would otherwise be beyond most private investors.

The companies receiving investment include new shares of privately owned companies that are traded on alternative markets, such as AIM and ISDX.

Governance is aided too by regulation covering tax and company law and the exchange on which they are listed.

There are also administrative benefits for both the investor and the VCT provider as the investor only has a pooled investment in the trust shares not all the underlying companies as with enterprise investment schemes. And we’d note that one large provider departed from the evolving and administratively challenging EIS marketplace in 2016 to focus on its leading position in VCTs.

The listing of the VCT means there is the possibility of a secondary market in the VCT itself – although in practice liquidity is, shall we say, varied. There are several reasons for this, the relief only applies to purchases of new shares, there’s the minimum holding period and those shares that do trade are often trade at a discount to net asset value (NAV).

There are two types of VCT, limited life and evergreen and as the name suggests the former are for a fixed period of 5 years and offer a known exit point which may aid secondary market liquidity. Some also offer a buy-back option where investors receive a price between 5-10% discount to NAV. And the fixed exit point means they also tend to have a bias towards asset backed ventures.

In contrast, evergreen VCTs are listed without an end date and form the majority of VCTs. Some of the different tranches or vintages have provided excellent returns – particularly in the benign credit environment since 2008. They can be split into three distinct strategies – AIM, specialist or generalist.

AIM VCTs invest in new companies listed on that exchange and that requires the manager to develop relationships with the broking community in order gains access shares as they come to market for the first time. When, hopefully, the investments rise in value they can be sold at the discretion of the manager and the resulting monies distribution to trust shareholders.

Specialist VCTs target a specific area of investment expertise such as a specific industrial sector, which may be high growth such as technology. Being less diversified naturally adds to risk profile of the VCT.

Generalist VCTs form the bulk of the trusts on offer. As the name suggests, they invest in a broad range of unquoted companies across a wide range of industrial sectors and look to exit either via flotation or direct sale.

While VCTs are not the largest of the governments venture capital schemes, they are entirely populated by specialist fund managers and governance and administration are clearer. In the tax year to April 2017 well over £500 million was invested in this way. There is also more of a definable track record for the major participants and less moving of the regulatory goal posts than with EIS – although this is by no means certain to be maintained.

There is no IHT relief, but given that the investment (limit £200,000) is held for five years capital growth is tax free as are dividends and income tax relief of 30% of the invested amount in claimable.

VCT offers tend to come in one of three ways, as new issue raising money for the first time, as a top-up for an existing vintage of VCT or an offer that raises funds for several VCTs run by the same manager.

In terms of specific risks for this type of investment the focus is really on the means of providing liquidity and exit as much as the possible investment performance. And there are conflicts of interests that need to be monitored with appropriate due diligence across the tax efficient investment space as well as within VCTs between different tranches.

Please consult our list of the main risks here.