Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

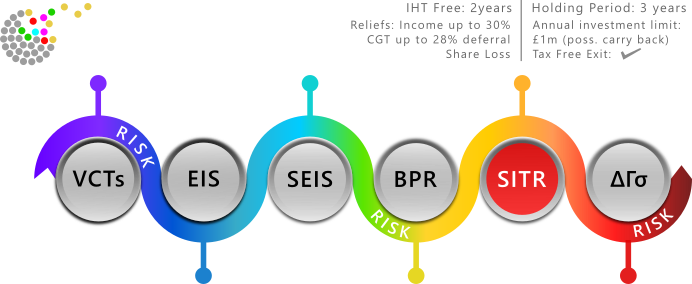

SITR – Social Investment Tax Relief

Social Investment Tax Relief is one of the four venture capital schemes promoted by HMRC. It has only been available since the beginning of the 2014 tax year and aims to help social enterprises and charities raise finance from individuals interested in creating a social impact with their investment.

Eligible investments include debt as well as equity.

There are two debt options: unsecured loans, which are interest only for the first three years and social impact bonds where payout is dependent on a specific social impact target being met. According to a report by the NPC charity think tank and the social investment bank, Big Society Capital, of the roughly £3.4m deals completed by last summer, 80% were in the form of unsecured loans.

While this is currently a far smaller area of tax efficient investment than the other three government venture capital schemes, more generous contribution limits from the beginning of the 2017 tax year aim to encourage SITR development.

Eligible organisations can now raise £1.5 million in this way, an almost fivefold increase on the original three year rolling total limit of €344,827. That rather explicit number derives from the fact that SITRs were introduced under EU rules.

They can also obtain advanced assurance from the Small Company Enterprise Centre as is the case with the other venture schemes. This is optional but it has become something of a due diligence essential for investors.

As with other venture schemes organisations must comply with certain criteria – they must have a ‘defined and regulated social purpose’. They are also defined by HMRC as ‘charities, community interest companies or community benefit societies carrying out a qualifying trade, with fewer than 500 employees and gross assets of no more than £15 may be eligible.’

Individual themselves may invest up to £1 million in this way which can be across more than one social enterprise. And relief is claimed via self-assessment using documentation provided by the compliant SITR.

This investment limit is independent of any limits that apply to the Enterprise Investment Scheme and the Seed Enterprise Investment Scheme.

Whatever the amount of their investment in SITRs, 30% of that figure may be deducted from their income tax liability providing that the investment is held for a minimum of three years. Capital gains can also be deferred to the point when the social investment is sold or redeemed. CGT is not applied to the investment, but given the weighting of investments towards unsecured loans this is less relevant – tax is payable on interest earned.

The standard key investment risks apply, but the bias of investment risk towards unsecured loans where the payout is more likely to be binary should not be underestimated. But it is important to treat each investment on its merits. Some offers are becoming quite diversified in terms of the broad spectrum of social projects they are funding. One FT article noted the range of investments extends from saving a village pub to expanding a community sports centre. However, most opportunities are based in education, employment, rehabilitation and training.

We have yet to complete a full due diligence of a SITR scheme. The one that we did look at had a significant flag in the information memorandum that meant we stopped at that point. But, that absolutely does not mean that we suggest SITRs should be avoided. It’s just that we need to do more work and, as part of that, we aim to engage with some of the early developers in this area to aid those wishing to make social impact investments and their advisers.

We also appreciate that some impact investors are happy with the risk and would define their contribution as more akin to a donation. Please consult our list of the main risks associated with this type of investment.