Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

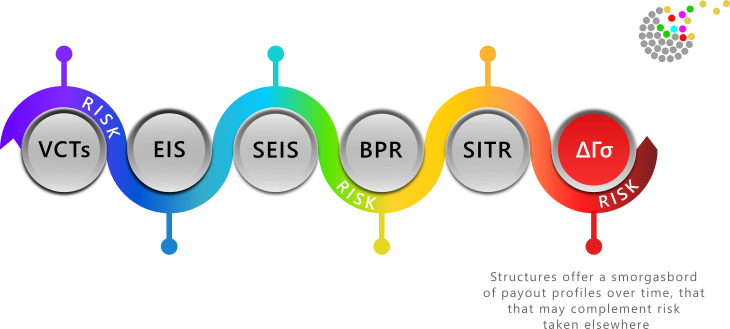

Structured Products

In our introduction to the four venture capital schemes we included a start date, but with structured products that rather depends on your definition of what they are.

For our purposes, a structured product is an investment that offers one or more payoff profiles to the investor over a set period of time. The most common are determined by the movement in an underlying stock index.

That may mean that they earn the investor a certain yield or get a set level of protection if the level of a stock market index is breached. Or it may combine a series of payoff levels.

We know for some of you that already seems too complicated and we will add some worked examples to follow at a later date.

The structures themselves are mostly created by investment banks who guarantee their performance and may also provide a secondary market. So, one of the main risks you have to consider is the counterparty risk to that institution.

The mathematics behind these products can be extremely complicated but they are all built from three essential building blocks: the volatility of the underlying index, interest rates and counterparty risk.

At the moment, all three of those elements are at historically low levels so if you are considering a structure that is offering you a yield that seems attractive you need to ask yourself – ‘how is that yield being generated?’

You might be underwriting at least two of those elements i.e. if volatility increases, credit deteriorates and interest rates rise you are very exposed.

It is not enough to just consider whether the yield looks great against current interest rates. You definitely need to know what is going on inside the tin, whatever the wording is on the front.

So, we’re going to start providing analysis of the current offerings in the marketplace and attempt to badge them for risk in a manner that will be easier to understand. And we really do have experience in this area. One of our directors, Chris Pearce, arranged one of the first gold based structures for a mining company in the late 80s! The price of gold was strong at the time and they wanted to hedge their future production at a guaranteed price. He has also arranged structures on individual stocks and indices in Asia as well as having traded credit default swaps as part of running a convertible bond desk.