Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

What are complex investments?

This is a broad term we use to cover tax efficent investments, structured products and other offers that contain layers of risk.

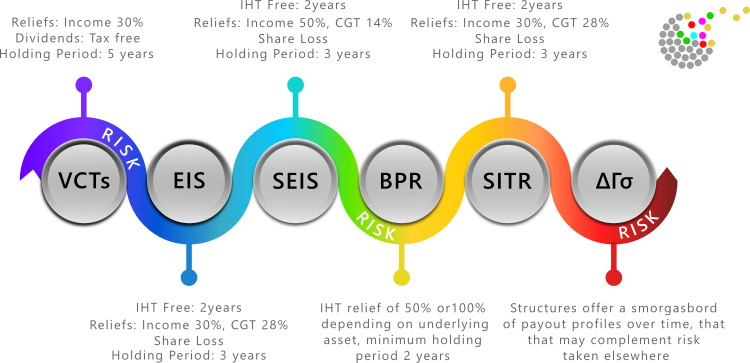

Tax Efficient Investments

This includes business relief schemes, VCTs, EIS & SEIS. As one manager of a leading business relief scheme put it, the holding companies can be ‘insanely complicated‘. The same investment group consists of almost 1,000 companies.

Structured Products

These may contain contingent investment layers or counterparties that need to be considered in addition to the derviative analysis.

Other complex investments

We have advised against a P2P and a cash management service. Both were eventually withdrawn

What do we look for?

We primarily assess individual products for suitability. If that is reasonable, we then consider whether the inherent risk can be mitigated further as part of a small portfolio of similar investments. Not all the risks we look for are black and white, sometimes you only ‘know them when you see them’, Below are some of the areas we cover on a regular basis.

Do you have any questions?

Due diligence number crunching

There’s a lot of digital work required, from writing code, parsing data, validation and analysis. But it still a needs to be supported by analogue work – sometimes with with risk you can only ‘know it when you see it’.

What people say about us

Our work is naturally quite discrete, but here are some comments from parties we deal with regularly.

Director, IFA Practice

‘This is an exceptional piece of work for which I am most grateful. I want to be brutally honest here and say that this shows that I don’t have sufficient understanding of counterparty risk & I would summon a guess that a fair few other advisers would be the same.‘

Network Director

‘Just wanted to thank you for your excellent piece of work. It is brilliant. Reads well. Balanced. Proportionate. And I thought you did a really good job nailing the nature of the risk.’

Leading product provider

‘‘With regard to the corporate filings, the Finance team actually asked whether you might be willing to share the anomalies your algorithm smoked out so that they can amend or correct where appropriate’