Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

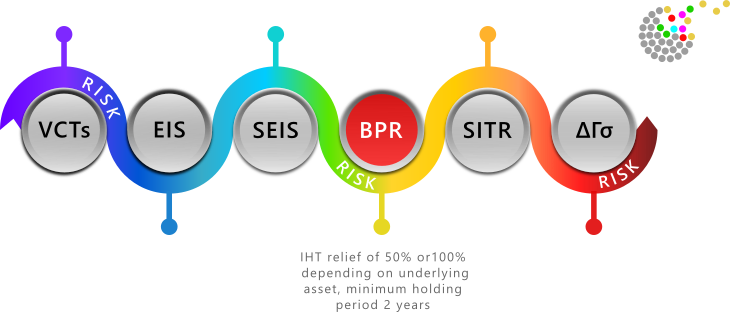

Business Property Relief

Business Relief (BR), or to give it its more common former name Business Property Relief, dates from the 1976 Finance Act. It was introduced to allow unlisted family businesses to transfer business assets between generations without attracting an inheritance tax liability at the time of death.

This has since evolved into a series of inheritance tax solutions whereby a private investment that has been held for at least two years in an eligible business can be passed on without attracting any inheritance tax on the amount invested. But, in doing so, the investor is assuming the risk inherent in owning shares in the eligible company which cannot be listed or involved in land, investment or property.

In truth, the eligibility rules covering a company and its assets are quite complicated and we don’t offer tax advice, but the main restrictions set by HMRC are detailed at the bottom of the page.

Special Purpose Vehicles

The most prominent of the solutions are the special purpose vehicles which aim to establish low risk compliant businesses specifically to benefit from BR. And the ability to generate cash or sell assets is an important consideration in order to provide a yield or to make redemptions.

The larger providers have established investment track records and are also able to demonstrate that their investments have been recognised in the past by HMRC as compliant and investors have received IHT relief as a result.

It’s important to appreciate that IHT relief isn’t guaranteed at the outset. The investment is only assessed by HMRC once the investor dies.

This is quite different to the income tax relief in venture capital schemes which is obtained upfront – providing those schemes remain compliant.

In the past year we have also seen two of these schemes offering the option of imbedded two year life insurance underwritten by a leading Lloyds syndicate to cover the loss of relief if the investor should die within the minimum holding period.

Enterprise Investment Schemes

Enterprise Investment Schemes (EIS) also offer a solution as BR is essentially embedded in the scheme providing the underlying investment remains compliant. The minimum two year holding period is the same. You can read more about EIS here, but it’s important to appreciate that unlike the special purpose vehicles, these aren’t set up with IHT relief as the primary objective – though some do attempt to maintain a lower asset backed risk profile.

AIM Investments

Almost half of the solutions available today invest in a portfolio of eligible AIM shares which are managed discretionally by a fund manager. While there might be over 500 eligible AIM shares to choose from liquidity from our perspective is more akin to pass-the-parcel than deep two way markets. And there is some justifiable concern that with the amount of money being attracted to AIM shares in this way, the demand for the relief is outstripping the investment case for the underlying. As with the other solutions the two year minimum holding period applies.

All of the above solutions are subject to general investment risks which are high. And it’s important to appreciate that tax rules can change and if an investor sells their shares or doesn’t hold them at time of death, they’ll lose exemption.

But, the two year minimum holding period does compare favourably with the seven year option provided by gifts and trusts – provided the investor is happy with the additional risk profile of the BR solution they’ve chosen.

Other considerations are that qualifying BR investments can be switched to other BR investments though in practice this might prove difficult. The investment will sit outside of the investors estate and will not affect their nil rate band and shares can also be passed to a spouse or civil partner should the original investor die within the two year period without resetting the two year time frame for eligibility.

Qualifying criteria for business relief (BR) taken from the HMRC website.

You can get 100% Business Relief on:

- a business or interest in a business

- shares in an unlisted company

You can get 50% Business Relief on:

- shares controlling more than 50% of the voting rights in a listed company

- land, buildings or machinery owned by the deceased and used in a business they were a partner in or controlled

- land, buildings or machinery used in the business and held in a trust that it has the right to benefit from

You can only get relief if the deceased owned the business or asset for at least 2 years before they died.

Non-qualifying criteria

You can’t claim Business Relief if the company:

- mainly deals with securities, stocks or shares, land or buildings, or in making or holding investments

- is a not-for-profit organisation

- is being sold, unless the sale is to a company that will carry on the business and the estate will be paid mainly in shares of that company

- is being wound up, unless this is part of a process to allow the business of the company to carry on

You can’t claim Business Relief on an asset if it:

- also qualifies for Agricultural Relief

- wasn’t used mainly for business in the 2 years before it was either passed on as a gift or as part of the will

- isn’t needed for future use in the business

If part of a non-qualifying asset is used in the business, that part might qualify for Business Relief.