Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

Great Scott!! – It’s the week of ‘Back To The Future Day’, the date in the second movie that they travel to in the Doc’s DeLorean – which, incidentally, doubles as the perfect retirement planning tool as he spends much of the 3-movie franchise trying to determine his own longevity.

This is also the week that I can finally introduce my own ‘dynamic’ retirement planning software, which isn’t quite as sexy or effective as a time-travelling DeLorean, but can draw on the practical and theoretical lessons in risk that I have learned and developed since first being introduced to them by a real doctor of mathematics soon after the original Back to the Future was made in 1985!

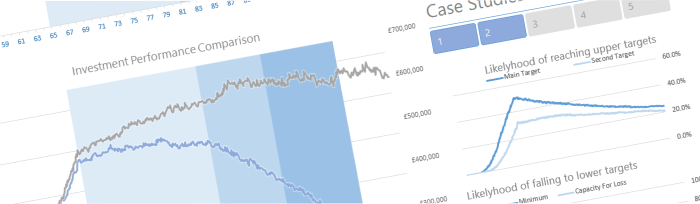

Since starting this company, I’ve never been entirely happy with the financial planning tools available to me – I will still be using the excellent CashCalc, but I wanted to be able to use the techniques that I’ve learned to illustrate with simple charts better answers for clients to questions like, ‘what is the chance that my money lasts my lifetime?’. And that can only help discussions about ‘risk’ and ‘loss’.

I had hoped to do this using some readily available dedicated software, but the few on offer weren’t versatile enough and I wanted to eventually apply more than one type of forecasting model. So, I decided to go ‘back to the future’ and write my own – and over 2000 lines of code later the first edition is finished and as it aims to look at a retirement plan and to sum it all up, that’s what I called it – SumItAllUp.

Over 1000 ‘What-if?’ calculations per month for each of five case studies

For a more thorough comparison with Dr Emmit Brown’s DeLorean take a look below, but SumItAllUp is no slouch. It can calculate over 1,000 ‘What-If?’ changes each month of a forecast and that can amount to over 1 million formulas in just 1.73 seconds on a standard laptop. And it also rebuilds itself for every individual case study – hence the ‘dynamic’ in the description.

But the biggest requirement was that I wanted not one ‘flux capacitor’ in the application, but five.

Even I have to admit that the DeLorean dashboard has a bit more going for it than the ones I designed for SumItApp – but, I reckon it has more features.

And there’s only ever been one model of DeLorean – I’ll be adding another two models once I’ve added even more ‘number crunching’ power. Why shouldn’t you have access to the same pricing techniques as a fund manager?

And being able to crunch five case studies at once means that I can choose to either compare different investment strategies and tax wrappers, for example a pension versus an ISA. Or, if more detail is needed, break an investment’s projected performance into different asset classes. But, it can also be used to combine the results of different case studies together, like the drawdown pensions of a couple.

The individual factors affecting your future pension income don’t all move in straight lines either and nor should your planner. So input changes like contributions or withdrawals can be made monthly, whereas some programs only update annually – that’s a big difference.

If you’d like to know more about this additional service please contact me.

SumItAllUp is exclusive to Pearce Wealth Management and I am offering it as an add-on to our normal planning service for no extra fee.

Designer – Dr Emmit ‘Doc’ Brown. With the help of plutonium stolen from Libyan rebels

Hardware/Software – One singe engine DeLorean fitted with a ‘flux capacitor’.

Energy Use – 1.21 gigawatts. According to a Buzzfeed article, that’s equivalent to 484 wind turbines, a nuclear power plant or 8 billion spinning hamster wheels.

Forecasting ability – perfect!

Price – You can find a variety of second hand and refurbished DeLoreans here. Unfortunately, they come without the ‘flux capacitor’ optional extra….and they’re in Texas.

Designer – my good self, using approximately 2000 lines of code and drawing on a variety of data sources including longevity data from the Office of National Statistics.

Hardware/Software – Standard laptop fitted with SumItAllUp

Energy Use – Approx 60 watts

Forecasting ability – However, sophisticated I make it, it remains a really useful forecasting tool – it can never be a guarantee of investment performance.

Price – There is no additional cost for using our SumItApp dynamic retirement planning service on top of our already comprehensive proposition.

Please remember:

- ‘Pension Theft’ is unfortunately a reality. If you are cold-called by unknown companies or advisers offering you something that seems too good to be true, then it probably is – all qualified advisers are listed in the FCA Register;

- Past performance is no guide or guarantee of future returns;

- Investment risks apply to all kinds of pensions. Values can rise and fall over time, so it is quite possible to get back less than what you put in, depending upon timing;

- This blog does not constitute financial advice and is provided for general information purposes only.