Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

Letter to The Times, 24th June 2016

‘Sir, It is now surely unthinkable that we can continue to call our country the United Kingdom of Great Britain and Northern Ireland. The only thing uniting us is our currency. Perhaps Poundland would be more appropriate’

David Jones W11

Beware of the Bull

I sincerely hope that, whatever your views on the Brexit vote, you’ll appreciate the succinctness and humour of Mr Jones’ letter.

Succinctness and humour are not however words I’d use to describe aspects of the rival ‘Leave’ or ‘Remain’ campaigns. I would not describe the sheer volume of analysis provided by financial companies as being a delight either.

A better description would be something I trod in while on a hike around the beautiful village of Braunston (nr Oakham). The sign in the picture gives you a clue as to its origin.

The first week after Brexit.

In my last blog I wrote,

‘It’s important to understand that, whatever the outcome of the referendum, that the world of finance is already very ‘stressed’.

And in the paragraph titled ‘Special FX’ I explained how in a world where central banks are managing interest rates (and indirectly asset prices), the only escape valves for economic reality are exchange rates.

In the week since the Brexit vote we’ve seen another example of what this can mean in practise with the sudden and abrupt changes in several currencies.

From coverage in the media you might think it was all about ‘Poundland’ and the fall in sterling, but there were also significant changes in the value of the yen.

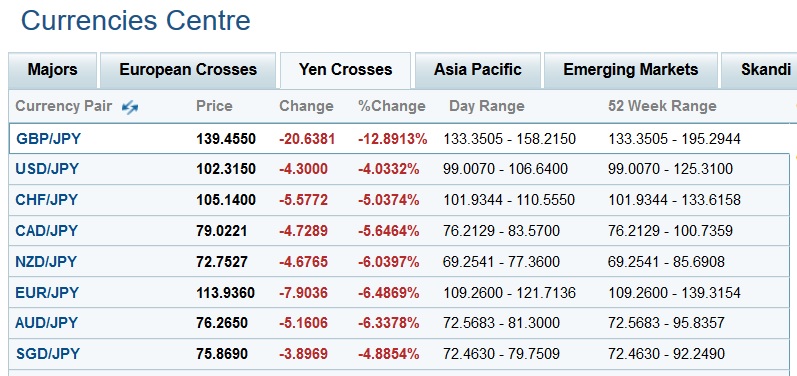

Bank of America Merrill Lynch, referring to the foreign exchange markets, called Brexit day ‘the most volatile day in modern history’. And it’s easy to see why. While all the talk was of the pound falling I took this screenshot of changes in the yen against a variety of different currencies.

Those are remarkable gains for the yen in one day, especially for a currency that its central bank wants to see weaken – but markets regard as a safe haven. And it highlights the bind central banks are in. They’re all pursuing variations of quantitative easing but they don’t all have the same economic fundamentals of debt, foreign reserves or balance of trade.

Perhaps the limits of quantitative easing are now being realised. And that could eventually have an impact on the beneficiaries of that policy, namely asset prices.

How to react?

In terms of what the effect of the Brexit vote has on personal finances there’s not much point on me adding to this article on the BBC.

From a purely investment perspective, you might wonder what all the fuss is about. The FTSE 100 where 70% of company earnings come from overseas – and therefore benefit from a weaker pound – is barely changed from before the vote. Albeit with a bit of a wobble in between.

But, inward looking UK companies did not fare as well, the FTSE 250 index is down 10%. And there will be implications for government debt if the pound keeps on weakening as overseas investors have been the biggest losers this week.

The standard advice is ‘keep calm and carry on’, but it’s a lot easier to do that if you have a professionally tailored plan.

To repeat what I wrote at the end of my last blog before the referendum –

‘The mispricing of rates and assets also means that we have to take great care and be especially wary with any income investment strategy. This will be as true of the trustees of pension schemes as those looking to grow and drawdown income from their own pension.

And it’s not just about the risk of prices moving up and down. It’s also about liquidity risk, the ability to get to your money when you want to.

I’d add, for those of you who might have a significant foreign exchange risk now, or sometime in the future, please get in touch and I’ll explain some options that are available to you.’

In light of the cancellation of withdrawals from three commercial property funds my constant banging on about liquidity risk remains a valid as ever. It’s not that you should avoid illiquid assets entirely just that you need to manage the amount of exposure and check if there’s a better alternative.

You also need to understand that the ease at which you can get money out of certain investments can change as it has with the commercial property funds. I remain very concerned about the p2p loan market for example.

More on that soon.

Please remember:

- past performance is no guide or guarantee of future returns;

- the value of stock market investments can rise and fall over time, so it is quite possible to get back less than what you put in, depending upon timing;

- this blog does not constitute financial advice and is provided for general information purposes only.