Address

39 Fen End Lane.

Spalding, Lincs. PE12 6AD.

For the last fortnight the press has been full of articles about annuities in light of the Chancellor’s decision in the Budget to remove the requirement in 2015 to purchase one with your pension pot when you retire.

What does this mean? Well for most of you it will mean you want to immediately leave this page and I appreciate that for many the idea of reading, as I have, the full Budget Report and its supplementary publications would leave you cold. But then that’s what I’m here for.

I even quite enjoyed it. I had originally planned a very different career in art and design and even applied for a job with the satirical TV show ‘Spitting Image’, but was advised in a very nice letter to do something more useful with my other qualifications and forget about painting puppets with an airbrush.

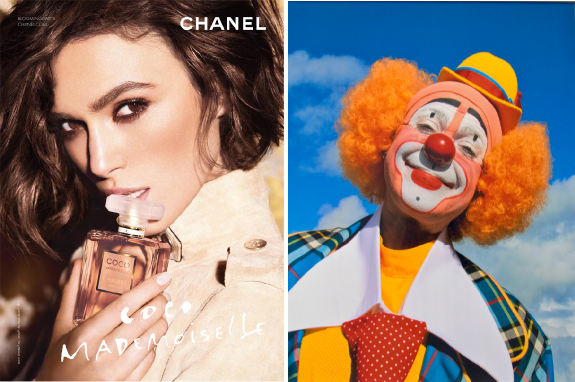

It was sound advice on their part. Some years later the limitations of my artistic skills were laid bare when I thought I’d offer to apply my wife’s make up for her. I was aiming for ‘Coco Chanel’, but she got ‘Coco the Clown’. Face painting at the school fete I can do, make-up no.

So returning to the budget, let me start by explaining a little about annuities and why they’ve become less generous.

A basic annuity is, in essence, the mirror image of a product many of you will be more familiar with – a simple repayment mortgage.

With a basic mortgage you borrow a lump sum for a fixed period and pay it back in monthly increments including the interest on the loan. A simple annuity is the opposite, you effectively loan a lump sum and are paid a monthly income including your original loan.

If I work out the monthly cost of a 15 year, £100,000 mortgage at an interest rate of 3%, it would be exactly the same as the amount I would receive monthly for an annuity for the same term at the same rate i.e £ 698.

(Now this is purely an example to demonstrate how the mathematics in this case is the same for both products. In practice, of course, there would be differences especially in the interest rate, fees etc. But given mortgages and annuities represent the two of the largest financial decisions an individual can make I’d be happy to send you a fully worked example – the maths involved falls within GCSE level)

So while falling interest rates are good for mortgage borrowers they’re bad for annuity holders. And if I spread the loan and monthly payments over a longer period, they fall for the mortgage borrower, but also mean less income for the annuity holder.

And this last point is particularly true for the type of annuity that was required to be bought with your pension savings – a lifetime annuity. As the name suggests the term over which the annuity is repaid is determined by how long you live, after which payments cease. And as average life expectancy has increased life companies have had to increase the length of time in which they expect to make payments – lowering the calculation of monthly income. It also is why those buying an annuity who can demonstrate a recognised life impairment which implies a lower life expectancy are able to receive higher monthly payments.

Now there are other types of annuity that cater for other client needs, but its hard to escape the realities of increased longevity and a government sponsored low interest rate environment that makes them less attractive – and that low interest rate environment may not last, whatever the governments wishes.

And when such an investment is forced (see first note below) as was the case, it can only add to the sense of frustration. It’s also true that the rates offered for small pots were poor and that despite ensuring that clients be made aware that they could shop around for their annuity purchase not enough did.

To return to the original question, what does this mean?

To begin with what has not changed is that you are still going to need to understand, or know someone who does, the calculation above to have a better idea of how long your pension pot will last – and to regularly reconcile that with the risks of the investments held in your pension and your own personal circumstances. The government says it intends to provide free advice, but hasn’t yet said how it will do so.

There is expected to be a huge fall in the number of new annuities sold – they hardly exist in Australia and represent only 5% of the US market. I doubt it will be this absolute, but there are concerns that a dramatic fall in the number of policy holders worsens the pooling of longevity risk for life companies because they become less certain that a smaller pool of policy holders matches their assumptions. (This is quite easy to understand, it’s just like saying the more times you toss a coin, the more certain you are that exactly half will be heads and half tails). There is also the suggestion that the pool of people buying annuities will become biased more towards those expecting to live longer, again lowering rates.

But, and this is very important to appreciate – no other product offers the same guarantee at the same rates at present. And payments are also 90% protected by the Financial Services Compensation Scheme – the income is also tax free if used to provide long term care.

No doubt, annuity providers and others will also begin to offer more hybrid products although I will view these with great scepticism unless they can demonstrate transparent fees and performance.

One final implication of the changes is that on death a pension pot fully invested in an annuity is worth nothing, but with these changes more pensions will be left with funds still in them, which currently (depending on certain circumstances) are taxed at 55%. But there is a suggestion this will be lowered. Page 26, section 3.17 of the supplementary Budget guide ‘Freedom and Choice in Pensions’ has this to say:

‘In particular, the government believes that a flat 55% rate will be too high in many cases given that everyone with defined contribution pension savings will now have the freedom to enter into drawdown rather than an annuity. We will engage with stakeholders to review these rules to ensure that the taxation of pension wealth at death remains fair under the new system’.

I told you I read it.

And finally, I mentioned ‘Spitting Image’ earlier, which coincidentally began 30 years ago, and here is a short example of their work. The target of their satire is the Budget of the then Chancellor Nigel Lawson, who is probably more famous these days as Nigella’s dad.

http://www.youtube.com/watch?v=8xFdfc4VnL8

Note: 25% of funds can be withdrawn tax free and this will remain the case. The balance you could either invest in an annuity or limit your withdrawals as though you had invested in one – this is set using the government actuary department rates +20% ( +40% next year) . The latter option allows you to keep the balance of your funds invested as you wish. If, however you can prove pension income over £20,000 you can withdraw the addition funds as you see fit subject to tax at your marginal rate – this amount falls to £12,000 next year.

Risk note:

Clients are reminded that the values of some kinds of investments can fluctuate over time; that past performance is no guarantee of future returns; and that it is possible to get back less than what you invested, especially in the early years.

This blog is based upon our initial understanding of the Spring 2014 Budget, but proposals may be modified or delayed by legislation.

Please therefore treat this content as general guidance only, and seek personal advice on specific issues.